Analyzing The Effectiveness of GST Implementation On Turnover Growth: A Case Study Of The Indian Automobile Sector”

DOI:

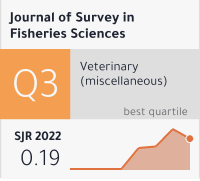

https://doi.org/10.53555/sfs.v10i1.2091Keywords:

GST implementation, Turnover growth, Indian automobile sector, Case study, Policy implicationsAbstract

This article presents a comprehensive analysis of the effectiveness of Goods and Services Tax (GST) implementation on turnover growth within the Indian automobile sector. Through a detailed case study approach, we investigate the impact of GST on various aspects of turnover, including sales revenue, profitability, and market dynamics. Drawing upon empirical data and industry insights, our study explores the specific challenges and opportunities faced by automotive businesses in adapting to the new tax regime. We examine key factors such as pricing strategies, supply chain management, and consumer behaviour to assess the overall influence of GST on turnover growth. Additionally, we discuss policy implications and strategic recommendations for stakeholders within the Indian automotive industry. Our findings contribute to a deeper understanding of the evolving landscape under GST and offer valuable insights for policymakers, businesses, and researchers seeking to navigate the complexities of tax reform in the automotive sector.