A Study into the Way Investors Perceive Mutual Funds, Specifically Focusing on SBI Mutual Funds

DOI:

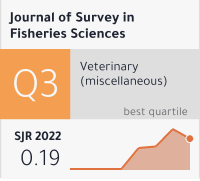

https://doi.org/10.53555/sfs.v8i2.2427Keywords:

Mutual Fund, Investors, Perception, NAV, SIPAbstract

In today's intricate and modern financial landscape, a mutual fund stands out as an optimal investment vehicle. The significance of mutual fund investments in India has been steadily increasing compared to other financial instruments. Not only do investments in mutual funds provide a safer option, but they also generate higher returns on portfolio investments. Mutual funds play a crucial role in mobilizing funds from small investors, contributing substantially to capital markets. This study provides a concise overview of the mutual fund industry, shedding light on the role of investment patterns and investor preferences influencing mutual fund investments.

Financial markets are continually evolving to offer more promising solutions to investors. Although the mutual funds industry is rapidly adapting to understand investor perceptions towards rewards, they are consistently striving to differentiate their products in response to sudden economic changes. Therefore, it is imperative to comprehend and analyze investor perceptions and expectations, extracting valuable information to support mutual fund financial decision-making. In recent years, mutual funds have emerged as a tool for ensuring financial well-being, contributing significantly to India's growth story and enabling families to benefit from the success of the Indian industry.

As information and awareness continue to rise, an increasing number of people are experiencing the advantages of investing in mutual funds. In India, the plethora of investment options poses a primary challenge for investors, ranging from bonds, fixed deposits, gold, stocks, to money market securities. Each option comes with its set of benefits and challenges, requiring investors to consider factors such as time horizon, risk appetite, and returns aligned with their specific goals.

Mutual funds offer numerous advantages, including comparatively higher Return on Investment (ROI), expert management, built-in diversification, ease of investing and monitoring, tax benefits, liquidity, and systematic withdrawal plans. The analysis and recommendations presented in this paper stem from market research on investors' saving and investment practices, providing insights into their preferences for mutual fund investments. The study findings aim to uncover investors' preferences in mutual funds, including their inclination towards specific Asset Management Companies (AMCs), preferred product types, growth or dividend options, and their choice of investment strategies (Systematic Investment Plan or One-time Plan).