A Critical Analysis Of Tax Structure In Tax Regime

DOI:

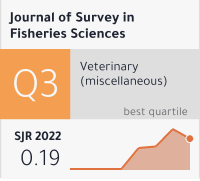

https://doi.org/10.53555/sfs.v9i1.3139Keywords:

Tax Structure, Tax Regime, Direct Taxes, Indirect Taxes, Economic Inequality, Tax Policy, Revenue GenerationAbstract

A critical analysis of the tax structure within the contemporary tax regime, exploring its efficiency, equity, and economic implications. The study examines various components of the tax system, including direct and indirect taxes, and evaluates their impacts on different socioeconomic groups. Using a comparative approach, the paper assesses tax structures in several countries, highlighting best practices and areas for reform. The findings suggest that while the current tax structures aim for revenue generation, they often fall short in terms of fairness and efficiency, leading to increased inequalities. Policy recommendations are provided to enhance the effectiveness of tax regimes and promote equitable growth.