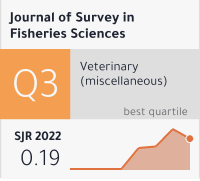

Evaluation of the Financial Performance of Chosen Commercial Banks in India

DOI:

https://doi.org/10.53555/sfs.v8i2.2450Keywords:

.Abstract

The present study aims to assess the financial performance of a set of Indian commercial banks from 2012/13 to 2016/17. This analysis encompasses 16 banks, with 11 from the public sector and 5 from the private sector. By utilizing financial ratios, the study compares the performance of these banks, revealing that private sector banks consistently outperform their public sector counterparts throughout the study period. Additionally, the study delves into the influence of liquidity, solvency, and efficiency on the profitability of these banks, employing panel data estimations such as Fixed Effect and Random Effect models. The empirical findings indicate that liquidity ratio and solvency ratio, as well as turnover ratio and solvency ratio, positively and significantly impact the profitability of selected public sector and private sector banks, respectively. This underscores the importance of these ratios in determining profitability.