A Study On Impact Of Non-Performing Assets On Economic Growth In India (A Case Study Of HDFC &ICICI Bank)

DOI:

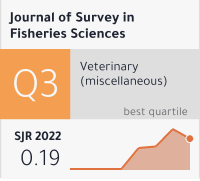

https://doi.org/10.53555/sfs.v10i1.2892Keywords:

Quality of Assets, Profitability, GDP Growth Rate, Non-Performing Assets, etc.Abstract

The purpose of this study is to determine how non-performing assets affect the nation's economic growth. We investigate the many, dependent or independent aspects that impact the nation's economic growth (such as profitability, interest margin, gross non-performing assets, net non-performing assets, etc.). Additionally, research instruments for this topic include the mean and standard deviation as well as tests of the significance of the link between the topic's independent and dependent variables. Correlation was utilized to test the variables. The "t" test is the one that validates the hypothesis, and the analysis is evaluated based on the results of this test. The study demonstrates that a subset of businesses positively impacted the nation's economic growth using analysis, statistics, and several performance measuring ratios from 2018-19 to 2022-23.